michigan use tax act

Section 20591 - Use tax act. MCL 20591 Use tax act.

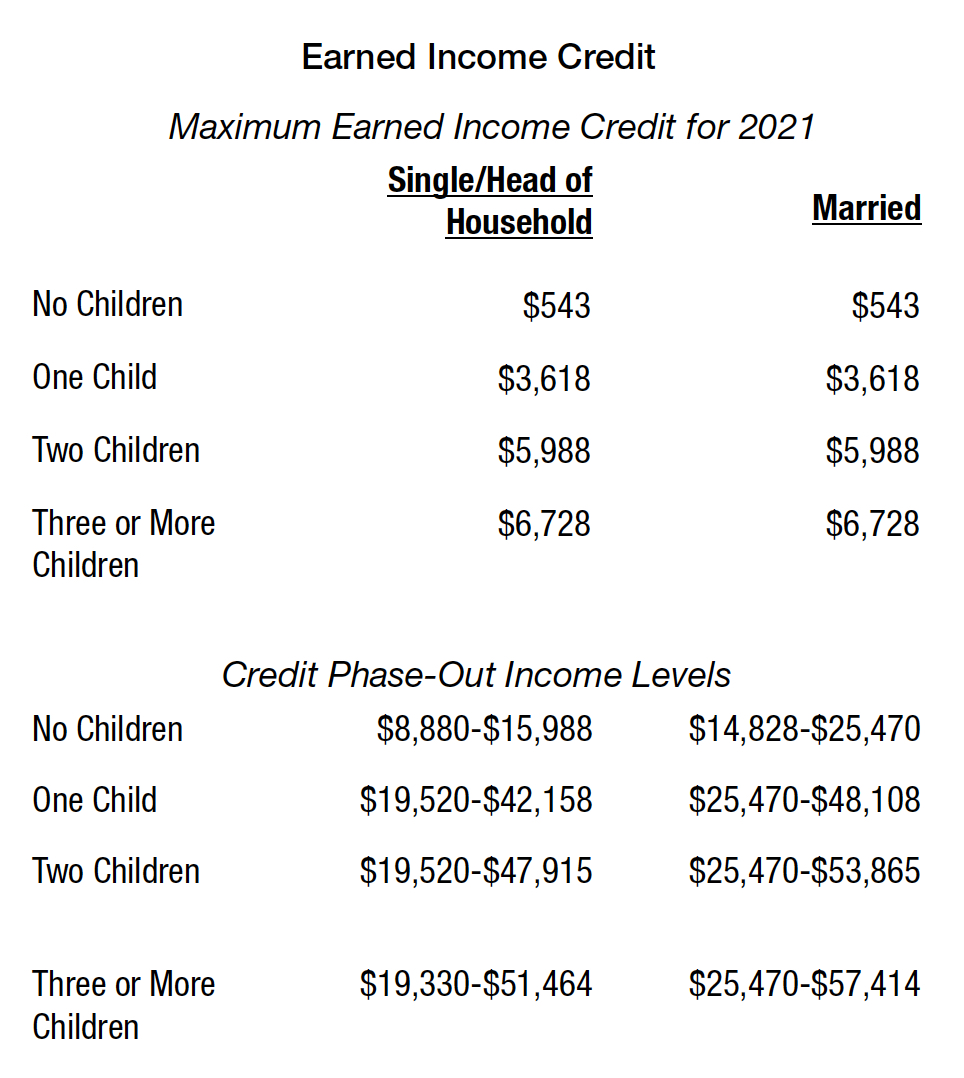

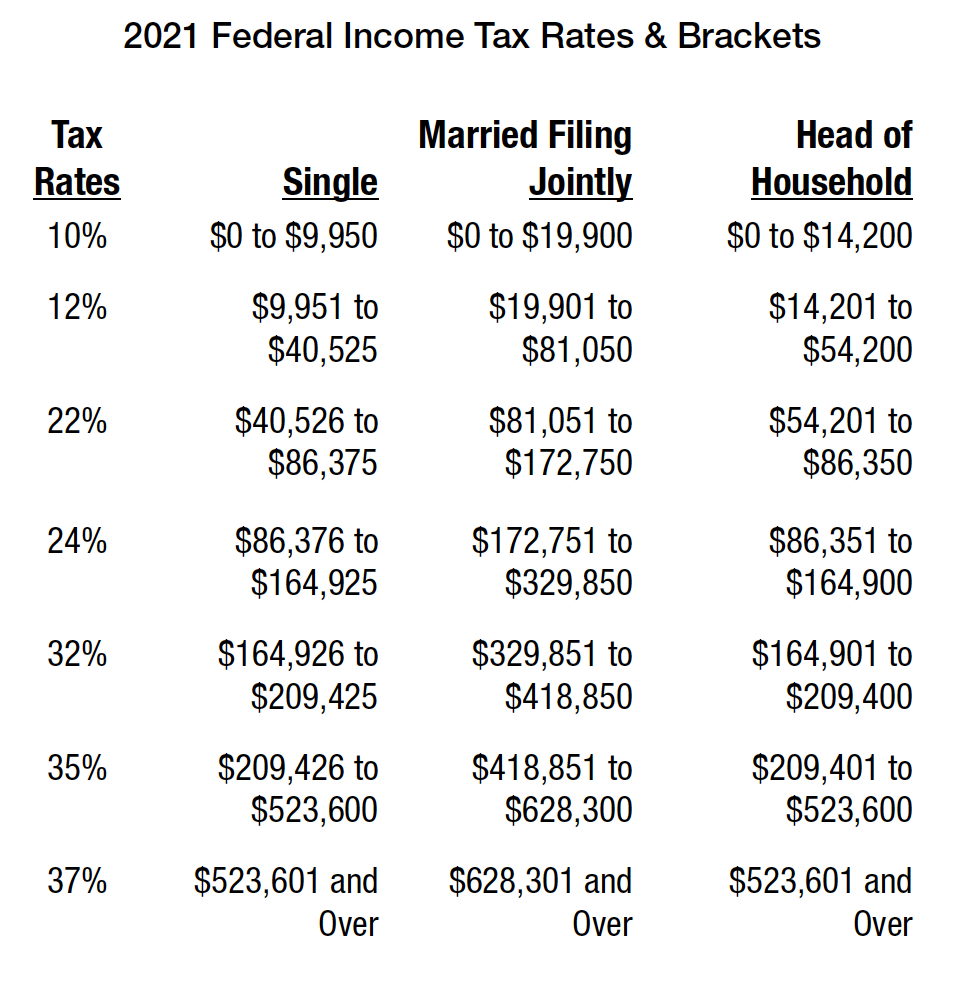

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

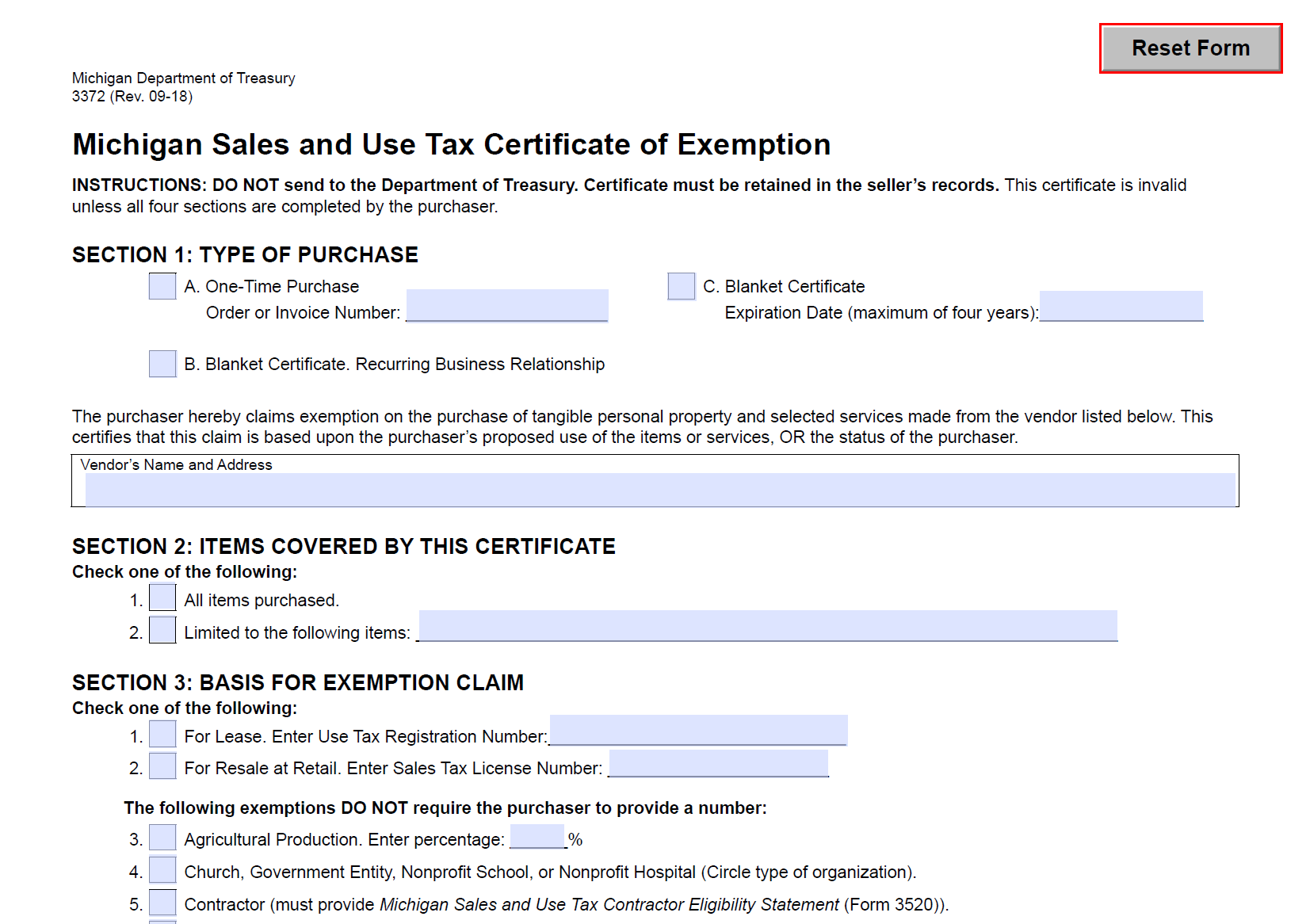

In 1988 the Legislature passed amendments to the Sales Tax Act affecting the agriculture production exemption.

. Get every penny you deserve with TaxAct 100 guaranteed. 04-21 Page 1 of 1 2022 Purchasers Use Tax Return Issued under authority of Public Act 94 of 1937 as amended. Start Your Return Today.

Michigan Use Tax Act. Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications. For businesses it is done on the same form as sales tax and.

Pay nothing to get it faster with TaxAct. Act 519 of the Public Acts of 1988 amended MCL. For Michigan residents the use tax is reported and paid on the annual Michigan income tax return MI-1040.

Any sales tax collected from customers belongs to the state of Michigan not you. This act may be cited as the Use Tax Act. In money or otherwise and applies to the measure subject Michigan.

The People of the State of Michigan enact. Sales and use tax in Michigan is administered by the Michigan Department of Treasury. Chapter 205 - TAXATION.

Michigan General Sales and Use Tax Acts. 31 MCL 20593 provides use tax you must pay Michigan 6 use tax due directly to. Aroma Indian Restaurant West.

Ad Your biggest refund possible is waiting. Michigan Department of Treasury 5087 Rev. Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone communications.

The Michigan Use Tax Act Sec. 2021 Michigan Compiled Laws Chapter 205 - Taxation Act 94 of 1937 - Use Tax Act 20591 - 205111amended Section 20591 - Use Tax Act. Mobile Al Sales Tax Rate 2019.

History1937 Act 94 Eff. Imposition of the Tax The Michigan Use Tax Act was created in 1937 with the enactment of Public Act 94 of 1937. This amendatory act is curative and intended to prevent any misinterpretation of the ability of a taxpayer to claim an exemption from the tax levied under the use tax act 1937 PA 94 MCL.

The amendment to the Use Tax Act will not take effect unless approved by a majority vote at an election that. Pay nothing to get it faster with TaxAct. Michigans spelling is primarily sourced from the original spelling of the word which first.

As of January 1 2004 Prof. McIntyre Multistate Taxation in the Digital Age Wayne State University Law School. Ad Your biggest refund possible is waiting.

Rather this amount will remain part of the state component tax. MI Comp L. Get every penny you deserve with TaxAct 100 guaranteed.

USE TAX ACT Act 94 of 1937 AN ACT to provide for the levy assessment and collection of a specific excise tax on the storage use or consumption in this state of tangible personal. Tax Collector Near Me Brandon. Telecommunications - Michigan Use Tax Act MCL 20593aa and c imposes six percent use tax and authorizes the taxation of qualifying services provided as part of telephone.

20591 Use tax act. The People of the State of Michigan enact. Section 20592 - Definitions.

This act may be cited as the Use Tax Act. Start Your Return Today. M use tax means the tax levied under the use tax act 1937 pa 94 mcl 20591 to 205111.

The use tax was enacted to compliment the sales tax.

Pursuing A Michigan Asbestos Injury Claim Mesothelioma Lawyers Tax Attorney Tax Lawyer Injury Claims

Free Michigan Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Michigan Resale Certificate Trivantage

Michigan Sales Tax Handbook 2022

Michigan Sales Tax Small Business Guide Truic

Michigan Motor Vehicle Power Of Attorney Form Tr 128 Power Of Attorney Form Power Of Attorney Power

State Of Michigan Taxes H R Block

Donald Mains In Flint Michigan In 2022 Flint Michigan Community Capital Gains Tax

Michigan State Tax Refund Mi State Tax Bracket Taxact

The Best Ways To Spend Your Tax Refund Visual Ly Tax Refund Tax Return Income Tax

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Michigan Intestate Succession Flowchart Estate Planning Attorney Estate Planning State Of Michigan

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

How A Taxpayer May Obtain A Sales Tax Refund Zip2tax News Blog Tax Refund Sales Tax Refund

25 Things You Learn While Living In Michigan State Of Michigan Michigan Historical Newspaper

Michigan Republicans Agree To Income Tax Cut Plan Will Gov Gretchen Whitmer Veto Bridge Michigan

Michigan Standard Lease Agreement Form Download Free Printable Legal Rent And Lease Tem Lease Agreement Free Printable Lease Agreement Lease Agreement Landlord

Michigan Real Estate Power Of Attorney Form Power Of Attorney Form Power Of Attorney Power